- Home

- About Us

- Insurance Services

- Marine Insurance

- Life Insurance

- General Insurance

- Export-Import Insurance

- Container Insurance

- Motor-Car Insurance

- Two-Wheeler Insurance

- Health Insurance

- Home Insurance

- Travel Insurance

- Workmen Compensation

- Personal Accident Insurance

- Goods Carrying Vehicle Insurance

- Passenger Carrying Vehicle Insurance

- Compulsory Personal Accident

- Liability Insurance

- Overseas Travel Insurance

- Engineering Insurance

- Fire Insurance

- News & Events

- Contact Us

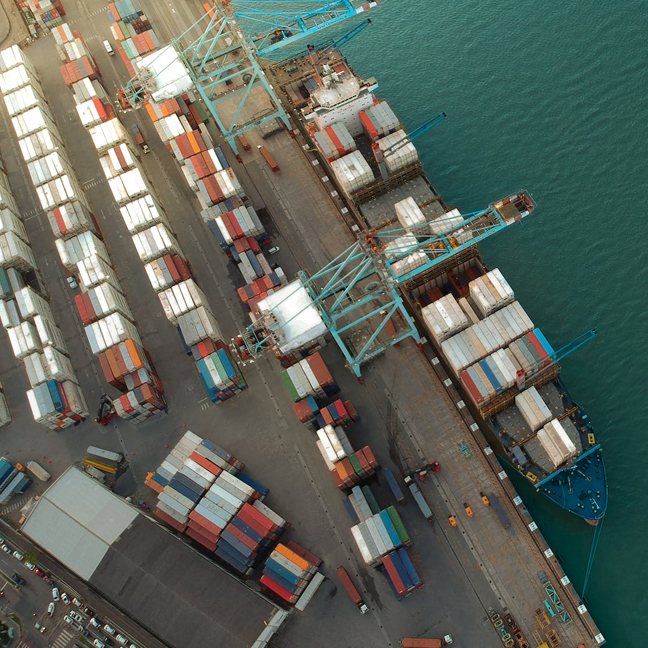

Secure Your Cargo

About Marine Insurance

Marine Insurance is a contract between the insurance company and the insured individual. Any loss or damage caused to the cargo during transit is covered by this insurance.

Shree Chintamani Insurance offers business owners a variety of Marine Cargo Insurance policies to provide coverage against various cargo losses and damages.

MARINE INSURANCE

Types of Policies

Under this policy, transit of material for Export, Import or Inter Depot movement from point of origin to destination gets covered.

Specific Voyage Policy, a Specific Single Transit can be covered . The Cover ends as soon as arrival of cargo at destination.

This is an Annual Cargo Insurance Contract expressed in general terms and effected for a round sum sufficient to cover a number of dispatches until the sum insured is exhausted by declarations. The Open Policy saves the assured the inconvenience of affecting individually the insurance of goods dispatched within the country. The policy may cover incoming and outgoing consignments to and fro in India. The sum insured under the policy should ordinarily represent the assured estimated annual turnover of the goods.

It is granted in respect of goods belonging to the Assured and or held in trust by the assured and not under contract of sale and or purchase which are in transit by road or rail from specified depots /processing units to other specified depots /processing units. Here Insurable interest remains with the insured. Policy not assignable or transferable. These policies are issued to transport operators/contractors, clearing and forwarding agents. Prohibited Policy is subject to the condition of average.

CONTACTS

CBD Belapur, Navi Mumbai